Context & Scouting

We begin by scanning macro shifts and frontier technologies across industrial sectors. This results in curated scouting aligned with our investment theses.

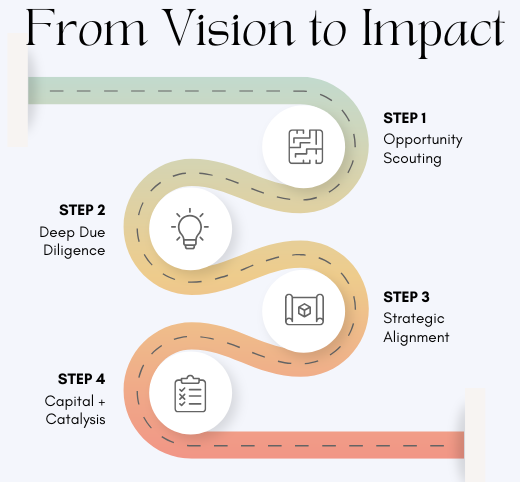

At Neovoltis, our process combines scientific rigor, strategic insight, and long-range vision. Each step is designed to derisk execution while amplifying technological, societal, and financial outcomes.

We begin by scanning macro shifts and frontier technologies across industrial sectors. This results in curated scouting aligned with our investment theses.

We co-design scalable roadmaps with founders — combining financial modeling, technical validation, and regulatory pathways to unlock industrial potential.

We deploy capital, connections, and continuous feedback. We remain deeply embedded in the venture’s journey from R&D scale-up to global deployment and post-exit strategy.

Each investment is structured to maximize industrial defensibility and real-world adoption. We don’t follow trends — we build long-term moats through patient capital and multidimensional strategy.

Whether it's a deeptech platform, an AI-native tool, or a cross-border rollout, we embed ourselves as long-term partners. Our solutions are designed for complexity, scaled for permanence.